You’ve probably seen it on the news or read it in a finance article—”The Fed increased rates by 25 basis points.” But what does that even mean? Especially when someone says “increase 1 basis point”? Don’t worry. Even if you have zero background in finance, we’re about to break it down in a way even a 10-year-old could understand.

What’s a Basis Point in Simple Words?

Let’s start with the basics.

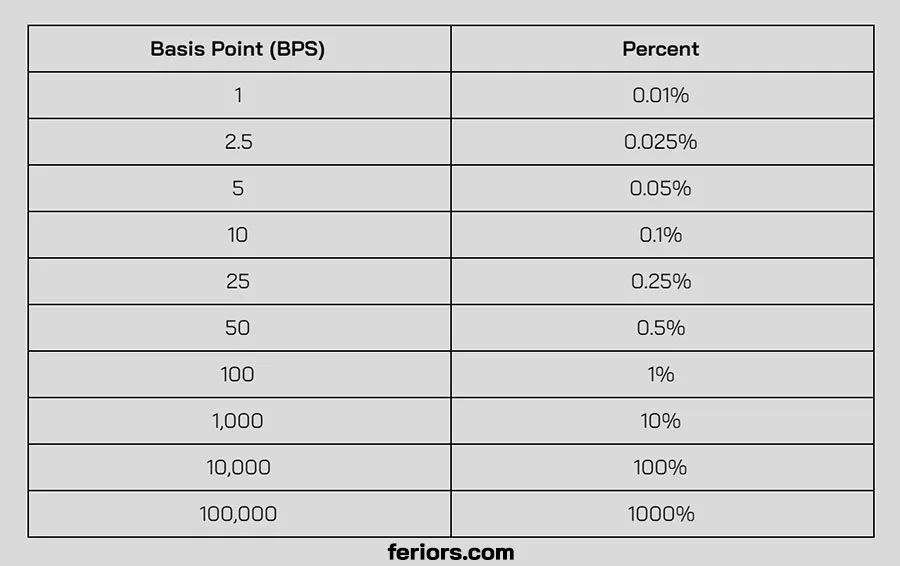

A basis point, often shortened to bps (pronounced “bips”), is a unit used in finance to describe tiny percentage changes, especially in interest rates or yields. One basis point is equal to 0.01%. That’s one-hundredth of a percent.

So, if an interest rate goes from 2.00% to 2.01%, it has increased by 1 basis point.

Think of it like this:

- 100 basis points = 1%

- 10 basis points = 0.10%

- 1 basis point = 0.01%

It’s used to make it easier to talk about small changes without confusion. Saying “0.01%” could be mistaken as “1%” if someone isn’t paying close attention. So finance experts prefer to say “1 basis point” instead.

Why Do People Say “1 Basis Point Increase”?

Good question.

When financial experts or news anchors say there’s a 1 basis point increase, they’re pointing out a very small change in a rate, often set by banks, the Federal Reserve, or bond yields.

It may sound tiny (and it is!), but in large-scale finance, especially when dealing with billions of dollars, even a single basis point can mean millions in interest payments.

It helps everyone—from analysts to bankers—communicate clearly and avoid errors when discussing small changes in percentages. Instead of saying “0.01%,” which could be misheard or misunderstood, they just say 1 basis point.

When Do We Use Basis Points?

We mostly use basis points when talking about interest rates, bond yields, savings, loan rates, and returns on investments.

Because changes in these numbers are often small, basis points make it easier to understand and communicate them.

Let’s break it down a bit further.

Talking About Loans

If you take out a mortgage or a personal loan, the interest rate matters a lot. Let’s say you’re approved for a loan with a 5.00% interest rate, but your credit score improves and now you get 4.99%. That 0.01% drop might not seem like much, but in finance terms, it’s a decrease of 1 basis point.

Now imagine that across a $300,000 mortgage. That small difference can add up to hundreds or even thousands over the life of the loan.

Talking About Savings

Basis points are also important for your savings accounts.

Let’s say your bank increases your interest rate from 1.00% to 1.10%. That’s a jump of 10 basis points.

Doesn’t sound like much? For someone with a $10,000 savings account, that’s an extra $10 per year. Now multiply that by millions of account holders, and you’ll see why banks take basis points seriously.

Stock Market and Basis Points

In the stock market, basis points are used when discussing bond yields or interest rate shifts from the Federal Reserve.

For example:

- A bond yield moving from 3.25% to 3.50% = 25 basis point increase

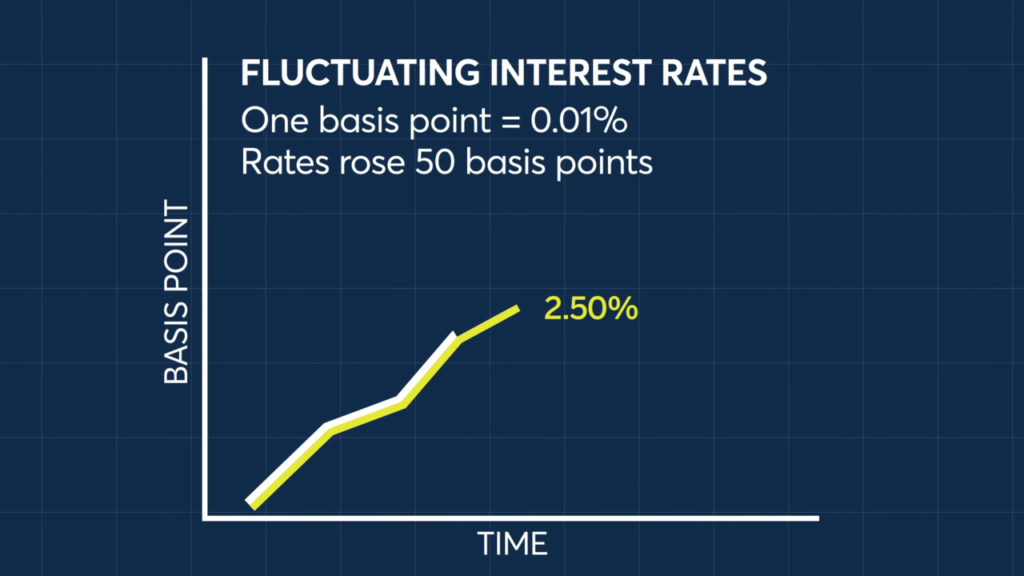

- Fed rate hike of 50 basis points = 0.50% rate increase

Traders use this language daily because it’s precise and helps avoid costly misunderstandings. Even tiny interest rate changes can shift entire stock markets.

How Much Is 1 Basis Point in Money?

Now let’s get into the dollars.

Since 1 basis point = 0.01%, you can calculate how much that is based on the total amount of money.

Here are some quick examples:

- On $1,000, 1 basis point = $0.10

- On $10,000, 1 basis point = $1.00

- On $100,000, 1 basis point = $10.00

- On $1 million, 1 basis point = $100.00

So, if a company borrows $100 million and pays 1 basis point more in interest, they’re paying $10,000 extra each year. That’s why banks, investors, and corporations care a lot about even a 1 basis point difference.

Is a Basis Point Always a Good Thing?

Not necessarily. It depends on the context.

If you’re saving money and the bank increases interest by 1 basis point, it’s good for you—you’ll earn a bit more.

But if you’re borrowing money and the interest goes up by 1 basis point, you’ll pay slightly more in interest.

In the stock market, a 1 basis point change in bond yields can signal a larger trend—either optimism or fear. So while the number seems small, it can have a big psychological impact on investors.

What Does a 10 Basis Point Increase Mean?

A 10 basis point increase means something has gone up by 0.10%. It could be a:

- Federal Reserve interest rate

- Mortgage loan rate

- Corporate bond yield

- Treasury rate

For example, if the Fed raises the federal funds rate from 4.25% to 4.35%, that’s a 10 basis point increase.

Let’s explore how this plays out in real-world settings.

The Fed and Basis Points

The Federal Reserve often adjusts interest rates in 25 or 50 basis point steps, but sometimes they make smaller adjustments, like 10 or even 1 basis point changes.

Even these small tweaks can influence the economy, affecting everything from car loans to savings accounts. Investors watch every Fed move closely—a 1 basis point change can trigger massive trading activity.

Credit Card Rates

Let’s say your credit card APR is tied to the prime rate, which follows the Fed’s rate. If the Fed increases by 10 basis points, your credit card interest could rise slightly.

On a balance of $5,000, a 10 basis point hike means around $5 extra in interest per year. Not huge, but it adds up, especially if rates continue rising.

Is 1 Basis Point a Big Deal?

For day-to-day purchases, probably not. But in big financial decisions or for companies dealing with millions or billions, 1 basis point is a big deal.

Banks, mutual funds, hedge funds—they all measure performance and risk in basis points. It helps them stay competitive and maximize returns.

So yes, in finance, a 1 basis point difference can move markets, change strategies, and impact profits.

Thoughts – Why You Should Care

Even if you’re not an investor or banker, understanding basis points can help you make better decisions. Whether you’re taking a loan, choosing a savings account, or watching interest rate news, knowing what “1 basis point increase” means puts power in your hands.

Financial literacy isn’t just for Wall Street—it’s for everyone.

The Bottom Line

A 1 basis point increase simply means something—usually an interest rate—went up by 0.01%. It sounds small, and in everyday life, it might not seem like a lot. But in the world of finance, banking, and investing, even one basis point can have a huge impact.

By learning this one simple term, you’ve taken a big step toward understanding how money moves in the economy. Whether it’s the Fed raising rates, your bank tweaking savings interest, or a loan offer changing slightly, now you know exactly what it means.