Palantir Technologies (PLTR) has become one of the most talked-about stocks in recent years. As a leading data analytics company, Palantir has secured major government and commercial contracts. But is PLTR stock a good investment? In this article, we’ll dive deep into PLTR stock price history, recent trends, future predictions, and the risks and rewards of investing in Palantir. Whether you’re a beginner or an experienced investor, this guide will help you decide if PLTR stock is the right choice for you.

What Is PLTR Stock?

PLTR stock represents shares of Palantir Technologies Inc., a company specializing in big data analytics. Founded in 2003, Palantir initially focused on government contracts, working with agencies like the CIA and Department of Defense. Over time, it expanded into commercial markets, offering data solutions to businesses in finance, healthcare, and manufacturing.

Palantir operates through three major platforms:

- Palantir Gotham – Used by government agencies for intelligence and defense.

- Palantir Foundry – Helps businesses analyze and manage their data.

- Palantir Apollo – A cloud-based system for managing software updates and operations.

Palantir went public in September 2020 through a direct listing on the New York Stock Exchange (NYSE) under the ticker symbol PLTR. Since then, the stock has seen significant volatility, attracting both bullish and bearish investors.

How Has PLTR Stock Performed?

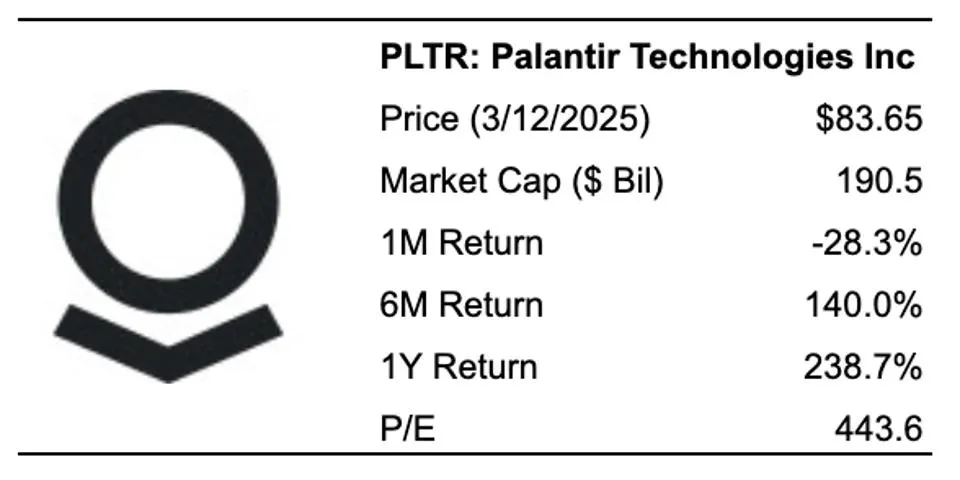

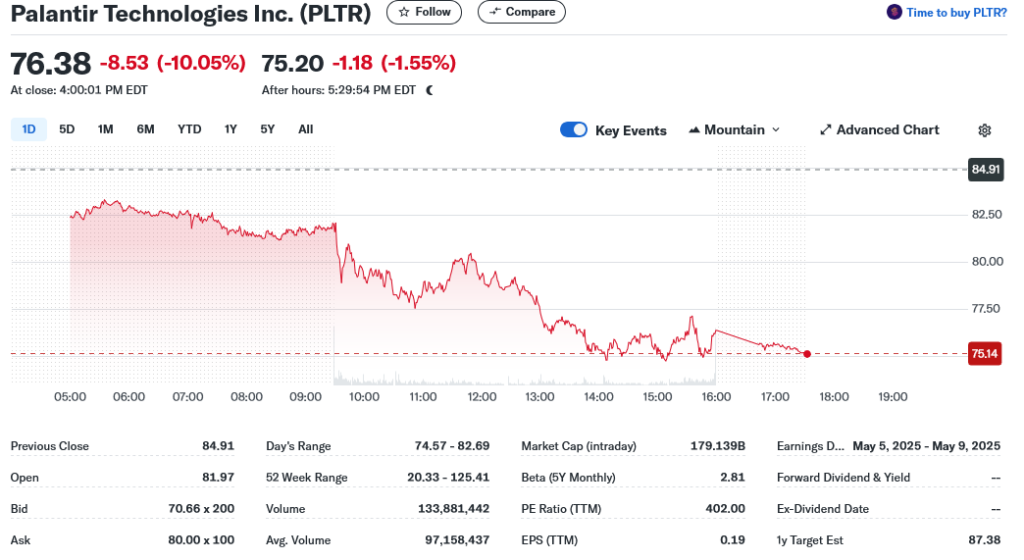

Since its IPO, PLTR stock has experienced dramatic ups and downs. It started trading at around $10 per share and quickly surged to over $30 within a few months. However, like many growth stocks, Palantir has faced periods of decline due to market conditions, earnings reports, and changing investor sentiment.

PLTR Stock Price History

PLTR stock price history is marked by strong rallies and sharp pullbacks. Here’s a quick look at how it has performed over the years:

- 2020 – Launched at $10 per share and pltr stock the year above $25.

- 2021 – Hit an all-time high of around $45, but later dropped below $20 due to market corrections.

- 2022 – Struggled during the broader tech selloff, falling below $10 at one point.

- 2023-2024 – Started recovering as Palantir secured more commercial deals and demonstrated improved profitability.

The stock remains volatile, often moving based on earnings reports, contract wins, and overall market trends.

Recent PLTR Stock Trends

- AI and Machine Learning Growth – Palantir is positioning itself as a key player in artificial intelligence (AI), which has driven renewed investor interest.

- Government Contracts – Continued partnerships with the U.S. military and other agencies provide stability to Palantir’s revenue.

- Commercial Expansion – More businesses are adopting Palantir’s platforms, helping to reduce reliance on government contracts.

- Profitability Improvements – The company has started generating consistent profits, which has boosted investor confidence.

Why Does PLTR Stock Move Up and Down?

Several factors influence PLTR stock price movements:

- Earnings Reports – Better-than-expected earnings push the stock up, while disappointing results cause declines.

- Government Contracts – New contracts with agencies like the U.S. Department of Defense can drive stock price increases.

- Stock Market Trends – If tech stocks are rising, PLTR stock often benefits. Conversely, during market downturns, it tends to decline.

- Investor Sentiment – Many investors view Palantir as a high-risk, high-reward stock, leading to strong buying and selling pressure.

Is PLTR Stock a Good Investment?

The answer depends on your investment goals. PLTR stock has high growth potential but also comes with risks. Investors looking for exposure to AI, big data, and government contracts may find Palantir appealing. However, those who prefer stable, dividend-paying stocks might see PLTR stock as too volatile.

PLTR Stock Forecast for the Future

Palantir has strong growth potential, especially with the rise of AI, data analytics, and cloud computing. Many analysts believe the company will continue expanding in both government and commercial sectors. However, competition, regulatory risks, and stock market volatility could impact future performance.

Bullish Predictions for PLTR

Many investors are optimistic about PLTR stock due to several reasons:

- AI and Machine Learning Expansion – As AI adoption grows, Palantir’s advanced analytics platforms could see increased demand.

- Strong Government Contracts – Ongoing deals with defense and intelligence agencies provide stable revenue.

- Commercial Growth – Palantir is signing more deals with major corporations, reducing reliance on government contracts.

- Profitability Trends – The company has started generating profits, which is a positive sign for long-term growth.

Some bullish analysts predict PLTR stock could reach $30-$50 per share in the next few years if the company continues executing well.

Bearish Predictions for PLTR

On the other hand, some analysts are cautious about PLTR stock due to the following risks:

- Valuation Concerns – Some believe the stock is overvalued compared to its earnings potential.

- Stock Dilution – Palantir has issued many new shares, which can reduce the value of existing shares.

- Tech Sector Volatility – If the tech sector experiences another downturn, PLTR stock could decline.

- Reliance on Government Contracts – While Palantir is expanding commercially, a large portion of revenue still comes from government clients, which can be unpredictable.

Some bearish forecasts suggest PLTR stock could struggle to stay above $20 if market conditions worsen.

Should You Buy PLTR Stock Now?

Before buying PLTR stock, consider these factors:

- Are you comfortable with volatility?

- Do you believe in Palantir’s long-term growth story?

- Can you handle short-term price swings?

If you believe in the company’s future, PLTR stock could be a great long-term investment. However, if you prefer stable stocks, it may not be the best choice.

Risks of Investing in PLTR Stock

While PLTR stock has potential, it also comes with risks:

- High Volatility – Prices can swing dramatically, making it risky for short-term investors.

- Stock Dilution – Issuing new shares can reduce shareholder value.

- Dependence on Government Contracts – Losing a major contract could hurt revenues.

- Tech Sector Uncertainty – Economic downturns and interest rate hikes could negatively impact the stock.

Bullish Predictions for PLTR

We’ve already discussed some bullish factors, but here’s a quick recap:

- AI-driven growth

- Expanding commercial contracts

- Profitability improvements

- Strong government partnerships

Thoughts on PLTR Stock

PLTR stock is an exciting but risky investment. It has the potential to grow significantly, especially as AI and data analytics become more essential. However, its stock price can be volatile, making it important to research thoroughly before investing.

The Bottom Line

Palantir Technologies is a high-risk, high-reward stock. It has strong growth potential, driven by AI, government contracts, and commercial expansion. However, it also faces challenges like stock dilution and tech sector volatility. If you’re a long-term investor who believes in the company’s vision, PLTR stock might be worth considering. However, if you prefer lower-risk investments, you may want to explore other options.